Is saving money challenging for you? Worry no more because you can save even if you only have a Gcash account through Gsave.

What is Gsave or Gcash CIMB Bank?

Gsave is a feature in your Gcash account where you can save your money like a regular bank account. It is built by Gcash and CIMB Bank. No need to go outside as you can set it up all from your Gcash app.

From your app, you can deposit from your Gcash account, check your balance, transaction history, and withdraw.

How to create a CIMB Savings Account in Gcash?

To be eligible in creating an account with CIMB, you must meet the following:

- Individual must be aged 18 and above

- A fully-verified GCash user

- You must be a Philippine citizen

- Have at least one (1) valid government-issued ID

Creating a GSave Account is quick and easy. Follow the instructions below:

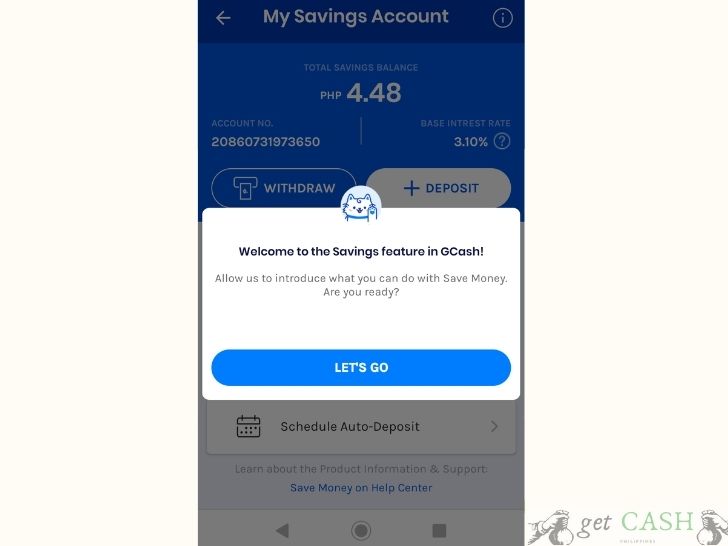

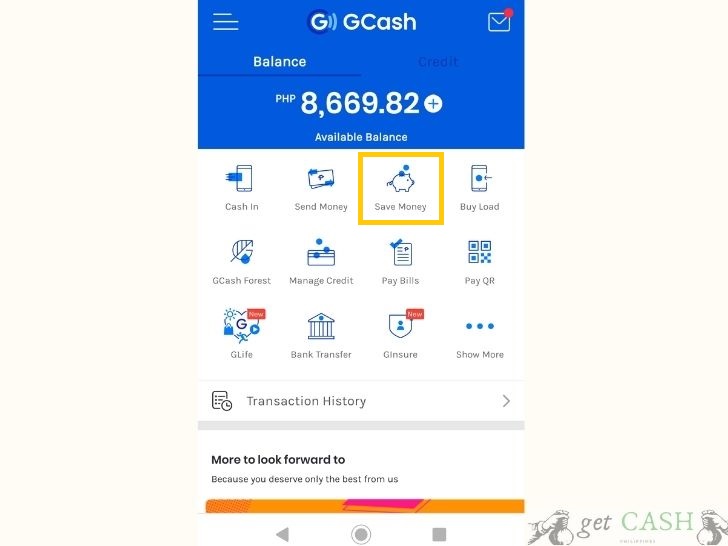

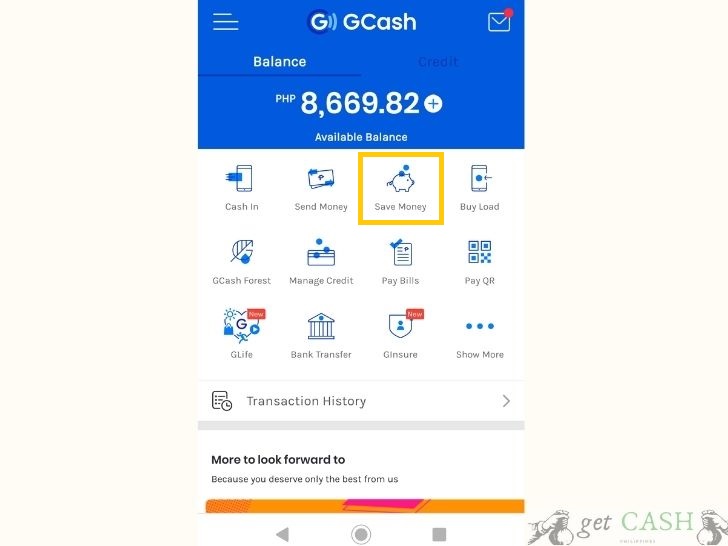

Step 1: Log in to your Gcash app and tap on the piggybank icon, with the label Save Money.

Step 2: You will be directed to the next page to register for your Gsave account. Fill in all the required personal information and tap on the Proceed button.

Step 3: Read and agree to the term and conditions by clicking on the Confirm button.

Step 4: You will be directed to a page that says Save Money Registration Successful.

What are the benefits?

Gsave is a digital savings account and comes with several benefits:

- Zero annual fees

- Manage your account through the App

- No initial deposit

- No maintaining balance

- No lock-in period

- No-hassle in moving funds to and from your GCash wallet.

- High-interest rate

Interest Rates versus other banks

Traditional banks usually have lower interest rates due to high operational costs. The interest rate is usually at 1 to 2% whereas Gsave offers a rate of 3.1% per annum effective March 1, 2021 (with the base interest rate will be 2.6% p.a.). The interest rate is also paid monthly without minimum or maintaining balance.

How to deposit money

After setting up your Gsave account, the next thing to do is deposit money from your Gcash account.

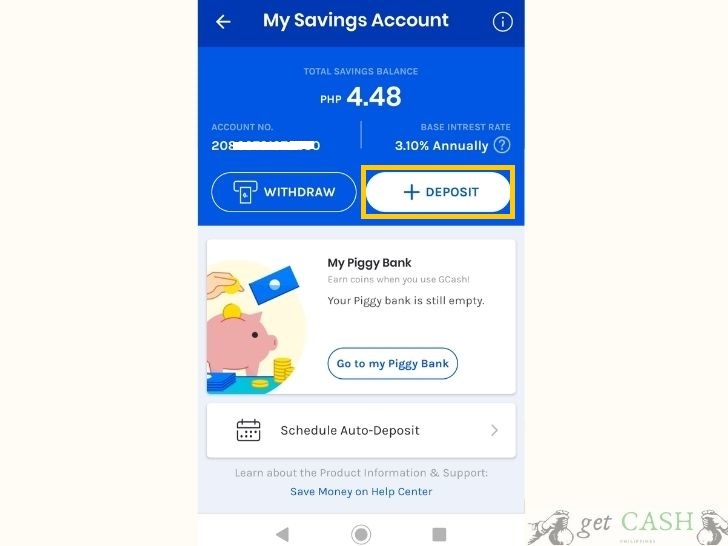

Step 1: On the Gcash dashboard, tap on the Save Money icon.

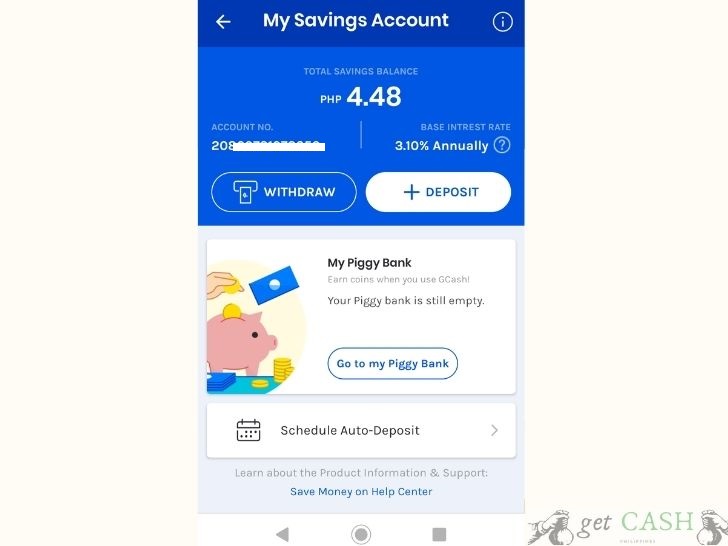

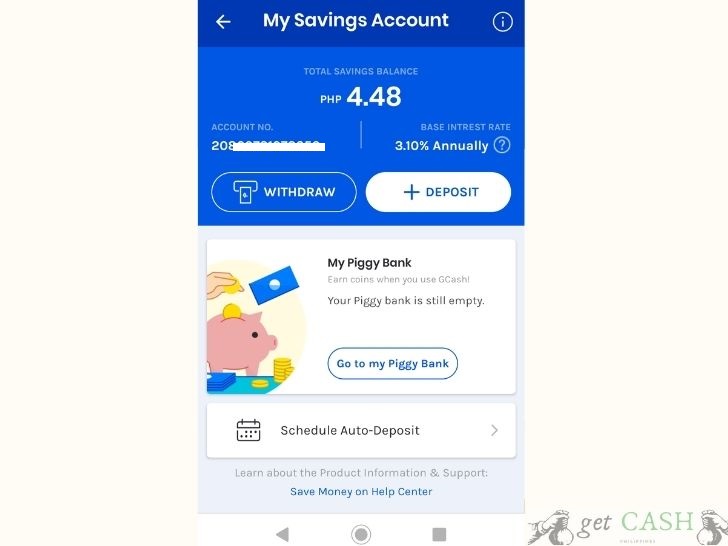

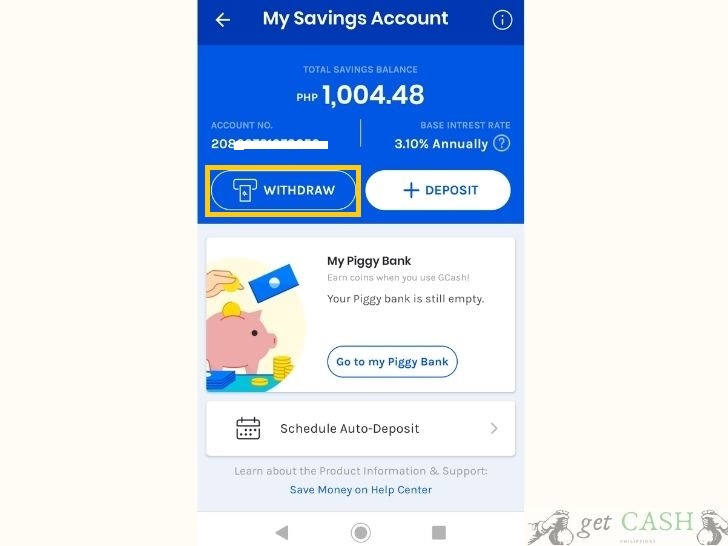

Step 2: You will be directed to the next page, My Savings Account. Under the Gsave Dashboard, you will see the following:

- Total Savings Balance

- Account nUmber

- Base Interest Rate

- Withdraw

- Deposit

- Schedule Auto-Deposit

- Transaction History

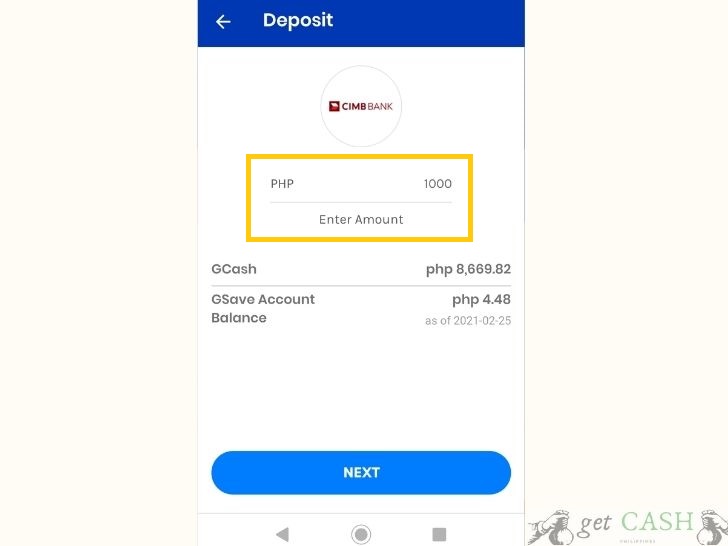

Select Deposit, enter the Amount you wish to withdraw, then tap on Next.

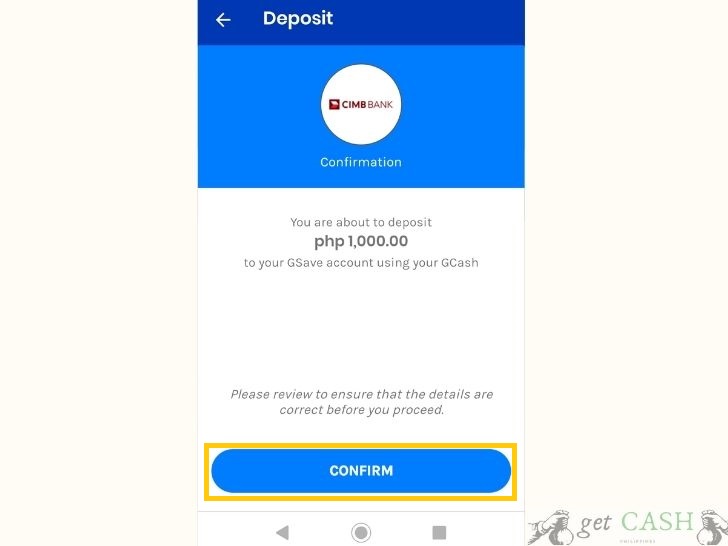

Step 3: Select Confirm to proceed.

Step 4: You will receive an SMS confirmation of the transaction.

Step 4: Another option is to set an automatic transaction from your Gcash account to Gsave through Schedule Auto-Deposit. From here, you can choose to deposit a specific amount weekly, bi-weekly or monthly towards your account.

The maximum amount you can deposit per day is Php 10,000.

The total deposit amount for 12 months is Php 100,000.00.

The validity period of the Gsave account is 12 months.

How to withdraw money?

Withdrawal is done through the Gcash Platform. The steps are as follows:

Step 1: On the Gcash dashboard, tap on Save Money.

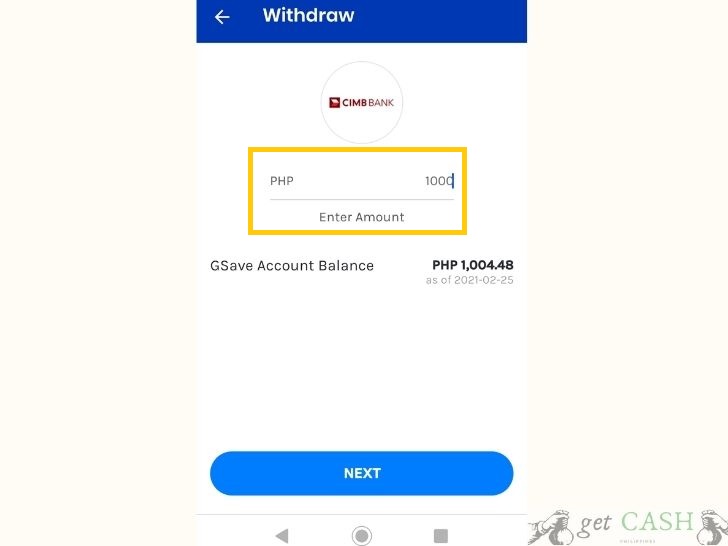

Step 2: You will be directed to the next page, My Savings Account. Under the Gsave Dashboard, select Withdraw. Enter the Amount you wish to withdraw, then tap Next.

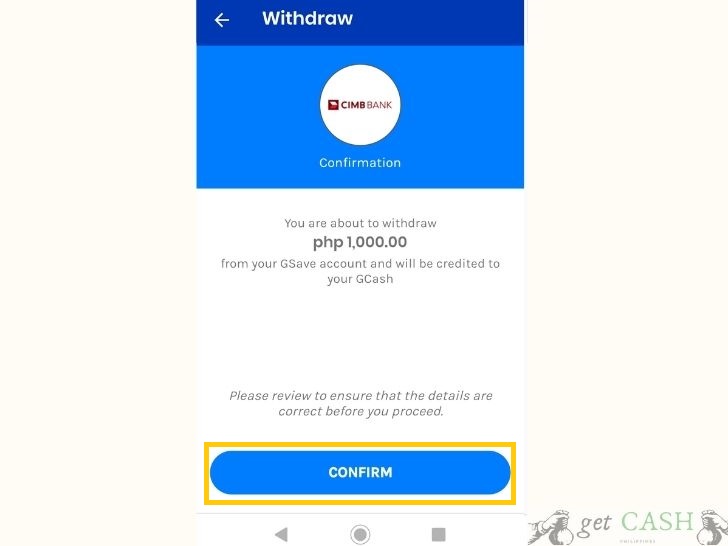

Step 3: Review the information you entered. Select Confirm to proceed.

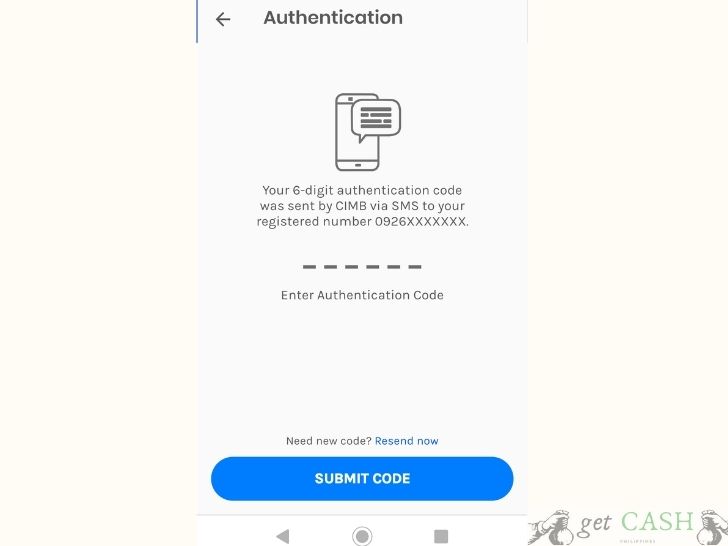

Step 4: Enter the One Time Pin (OTP) sent to the mobile registered with Gcash on the app.

Step 5: Once done, the money will be automatically transferred from Gsave to your Gcash account.

Step 6: From then, you can cash-out Gcash the usual way.

Withdrawal fees

The same charges will apply to the withdrawal fees of a normal Gcash account. Withdrawal through ATM has a fee of Php 20 while over-the-counter transactions charged 2% of the actual amount. All the fees are deducted from the amount you will cash out.

Gsave withdrawal limit

The maximum amount per transaction and day is Php 10,000.00.

What is Gsave plus?

Gsave plus is when you upgrade your Gsave account without having to go to the bank. Upgrading your account is done through CIMB Bank PH App. The Php 100,000 limit for 12 months removed from your Gsave account. You can also request a CIMB debit or ATM card.

Gsave versus Upsave

Gsave is how you regularly save from your Gcash account. Under the Gsave account, you are entitled to an interest rate of 3% p.a. for the next 12 months. However, no additional interest rate will be applied on amounts exceeding Php 100,000. The Gsave account is only good for 12 months.

Upsave, on the other hand, eliminates the Php 100,000 and 12-month limit. This allows you to enjoy the 3% p.a. interest rate for any amount exceeding Php 100,000. Also, Upsave entitles you to a Life Insurance Coverage worth Php 250,000. All the subscriber has to do is maintain an average daily balance of Php 5,000 for 12 months. No monthly premium or no fees will be charged to the subscriber.

In summary, Gsave is for short-term savers who wish to spend the money somewhere after 12 months. Upsave is for subscribers looking to save money in the long-term.

Gsave versus Gcredit

The biggest difference between Gsave and Gcredit is that the former is money at hand while the latter talks about money in credit.

Gcredit allows a qualified Gcash subscriber to borrow up to Php 30,000 and pay for an interest rate as low as 3%. Whether you consume the entire amount or not, you will be liable to pay for the entire principal and interest. Unfortunately, Gcredit is not convertible to cash and can only be used at accredited Gcredit merchants.

Gsave, on the other hand, lets you save your money for any future investments or purchases. Allows you to deposit and withdraw money at any time.

Technically, it is best to use the money you have earned and saved for any purchase or bill payments. Thus, Gsave is a great option over Gcredit. The latter works best for subscribers who are short of cash in purchasing items or paying for bills.

Gcash is not only a regular wallet because of the Gsave feature. Gsave is the digital bank made accessible for everyone. It helps every subscriber to think beyond merely cashing in and out their money but also earning from interest rate and having available funds for their future.

Read:

Last modified: September 6, 2021