Have your loans from the bank or government agency been rejected? And you were in dire need of cash but you had no one to turn to except for the loan sharks? Getting a loan is a tough job especially if you do not have enough documents or collateral to get one at the bank. Loan sharks are no help either because you often end up with a credit higher than what you took out. Gcash has the solution for your problem. That’s where Gcredit steps.

Gcredit

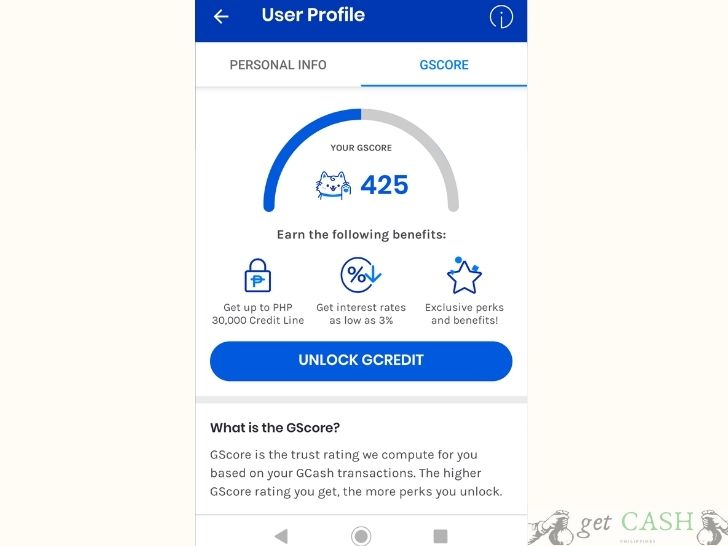

Gcredit is a credit line that you can get from Gcash. You can get a loan of up to Php 30,000, depending on your Gscore, which you can use to buy items and pay bills. Pay an interest between 3 to 5%.

Application process

So, how do you apply for Gcredit? The first thing that you have to understand before applying for a Gcredit is Gscore.

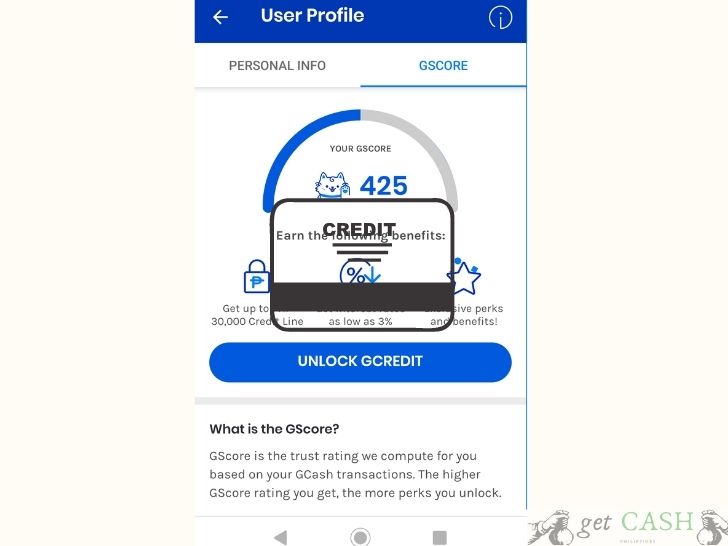

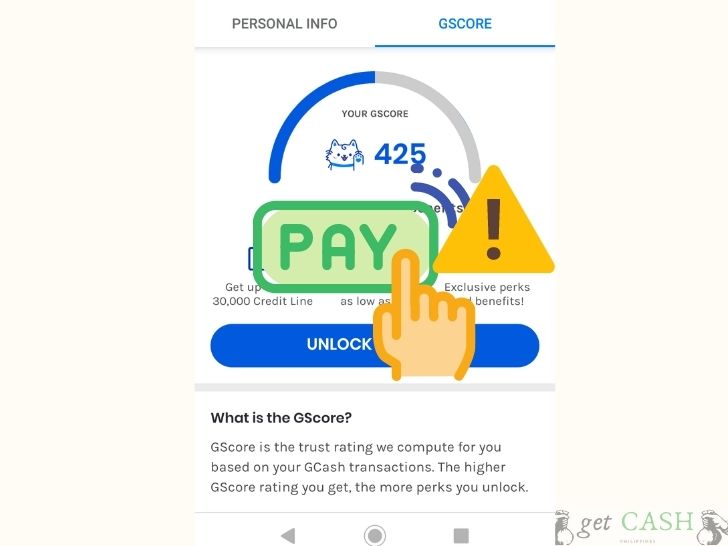

What is Gscore?

In the Philippines, there is no standard credit score rating like the US or China. This score is what financial institutions and merchants use to identify if you are reliable enough to get a loan. Gscore is the equal of the credit rating score in Gcash.

You can increase your Gscore by using the various features in Gcash and making regular transactions within the app. The higher your Gscore is, the higher the loan you can get.

To check your Gscore, tap on the three dashes at the upper left corner of the dashboard. Scroll down and select Gscore. You will see then your current score and tips on how to increase your score.

How can one increase his Gscore?

Since Gscore evaluates the quality of your transactions, the focus is on how you manage your finances through the app. Here are quick tips on how to up your score:

- Link a bank account in your Gcash.

- Make use of your Gsave and transfer money regularly. A bonus tip is that you can get a higher score if you set up an automatic debit to Gsave.

- Pay your dues on time.

- Use the following features: Cash-in, Pay QR, Pay Bills, and Invest.

- Leave a certain amount of cash in your Gcash wallet, at least Php 300 or so.

- Use the Gcredit feature and ensure to pay it on time.

- Avoid cashing in and out within the same day.

How to apply for Gcredit?

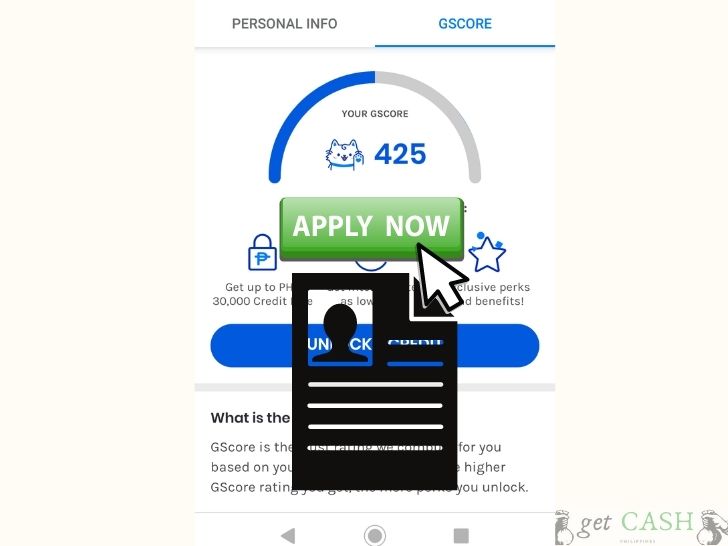

Step 1: You will receive an in-app notification and text message from Gcash, once your Gscore gets to the eligible number, to Activate Gcredit.

Note: Gcash has not disclosed the actual Gscore to unlock the Gcredit feature.

Step 2: Go to the app. Tap on Manage Credit Icon on the dashboard.

Step 3: Proceed to the application process. Confirm your email address and tap Proceed at the bottom of the page.

Step 4: Verify all the details on the Personal Information page. Once done, tap Next.

Step 5: Fill in all the necessary information such as:

- Year of Residence

- Other Mobile Number (optional)

- Landline Number (optional)

- Own Small Business? Choose your answer from the dropdown.

- Emergency Contact Information

Then tap Next.

Step 6: You will receive a notification once Gcash has approved your Gcredit application.

Use Gcredit

After receiving a confirmation that your gcredit has been approved, you can use the credit immediately.

Gcredit can be used to pay for your bills and also shop at QR partner merchants.

To shop, look for merchants with a Pay QR code next to the cashier. Refer to the list below for partners who accept Gcredit as payment.

Use the Pay Bill option on the Gcash app. Under Biller’s name, you’ll see a phrase that says Also accepts Gcredit.

Gcredit merchants

Among the popular Gcredit merchants are:

- A Refinery

- Abenson

- Adidas

- Adobo Connection

- Aji Ichiban

- Army Navy

- Ayala Cinema

- Baskin Robbins

- Bayo

- Bench Fix Salon

Check this link for a complete list of Gcredit merchants.

Gcredit Limit

The credit limit is based on the approved amount of Gcash from a minimum of Php 1000 to a maximum of Php 30,000. Gcash increases the limit as your Gscore increases. The good thing about Gcredit, compared to other credit cards, the amount refreshes every time you make payment.

For example, you were approved with a Gcredit of Php 5,000. If you used Php 2,000 for grocery and Php 1,000 for bills but paid back the entire Php 3000 in full before the due date. You can use the same amount again as a credit.

And if you settle your dues before the due date, you’ll be charged a lesser amount for the interest.

Interest

Another perk in getting Gcredit over other loans or credit cards is how the interest is computed.

How to compute for the interest?

The default interest rate of Gcredit is 5%. However, it can decrease as your Gscore gets higher. Moreover, it is not charged monthly but compounded daily. This means the sooner you pay, the lesser the interest is as the charge is prorated.

Example:

Let’s say, you borrowed from Gcredit Php 1000 payable in 1 month at a 5% interest rate.

Php 1000 + (Php 1000 x 5%) = Php 1050 Total payable

But, if you paid the entire amount after 7 days, the new computation will be:

Php 1000 x 5% x 7/30 = 11.67

Total payable is brought down to Php 1011.67

Formula is:

Principal + (Principal x Interest rate x (no. of days/30)) equals the total amount due (prorated)

How do I pay my GCredit dues?

Paying your Gcredit dues is simple. follow these steps:

Step 1: Log in to Gcash App.

Step 2: Under dashboard, Tap Manage Credit.

Step 3: On the next page, you will see the used credit, remaining credit limit, and total credit limit. It also includes the unpaid previous charges. Select Pay for Gcredit at the bottom.

Note that your interest rate will now show until the due date.

What happens if I miss paying for my credit line?

In understanding your billing statement, you need to know the following terms:

Billing Cycle is 30 days starting from your bill date.

Bill Date is the first day when the loan started. Also, the first day of the billing cycle.

Due Date is when the bill is due which is usually 15 days after the end of the billing cycle.

For example:

Billing Cycle: January 1-30

The due date is February 14

If you made a payment on February 15, you will be charged penalty fees. Here are the corresponding late fees that need to be paid on top of the principal amount and interest:

1 to 30 days = Php 200

31 to 60 days = Php 500

61 to 90 days = Php 900

More than 91 days = Php 1500

Can you use Gcredit in lazada?

No. Currently, Lazada only allows Gcash as payment. When there’s enough balance in your account, you will not be able to proceed with the payment.

How to use Gcredit in Shopee

Shopee Checkout

Step 1: Go to your Shopee app and shop.

Step 2: At the checkout section, tap on the Payment option.

Step 3: Select on Payment center or e-wallet. Tap Gcash.

Step 4: Select Gcredit as your source of payment. Click on Pay.

Take note that gcredit can only be used as a one-time payment for shopee.

How to use Gcredit in puregold

Via the App

Step 1. Log in to your Gcash account.

Step 2. Tap on GLife Icon on the Dashboard. Select Puregold.

Step 3. Choose Gcash on the next page then enter your e-mail address.

Step 4. Choose between pick-up or delivery. Read carefully what is written in the terms and conditions. Then enter the address where the items will be delivered. Here are some key points:

- You can only order between 6 AM to 7 PM daily.

- Same-day deliveries are for orders placed from 6 am to 2 pm.

- A fixed delivery fee of Php 175 will be charged to your account.

At the Store via scan to pay (QR Code)

Step 1: Open the Gcash app and tap on Pay QR.

Step 2: Select “Scan QR code.” Your camera will be activated. Align your camera to the QR code until it fit in the highlighted area.

Step 3: Enter the amount you wish to pay.

Step 4: Choose the method of payment. Ensure that you chose Gcredit. Confirm the amount.

Step 5: Wait for the confirmation text message.

Can I cash out with Gcredit?

No. Currently, Gcredit is restricted to online and actual shopping with accredited partners and paying bills via the Gcash app. It works like a credit card and so, you can’t transfer your remaining balance to your regular Gcash account.

Read: Withdrawing money from your e-wallet guide.

Gcredit not working

You will know that Gcredit is under maintenance when

- You do NOT see the “also accepts Gcredit” phrase under the biller’s name

- Or, when you can’t pay via QR.

To fix this, you can call the hotline 2882 or submit a ticket or contact customer service.

Final Thoughts

Gcredit is a secure, reliable, and convenient way to borrow funds without having to go through the complexities of a loan application. As long as you have a good Gscore, you’ll be approved for one. Maximize the various Gcash features and manage your account wisely to enjoy its full benefits.

Last modified: August 4, 2021