GCash, a mobile wallet in the Philippines, enables users to easily send and receive funds. Users can transfer funds to any GCash wallet, including their own, using the GCash app. However, how much can be transferred? What are the boundaries? This article will examine the GCash to GCash transfer limit in detail.

GCash to GCash Transfer Limit

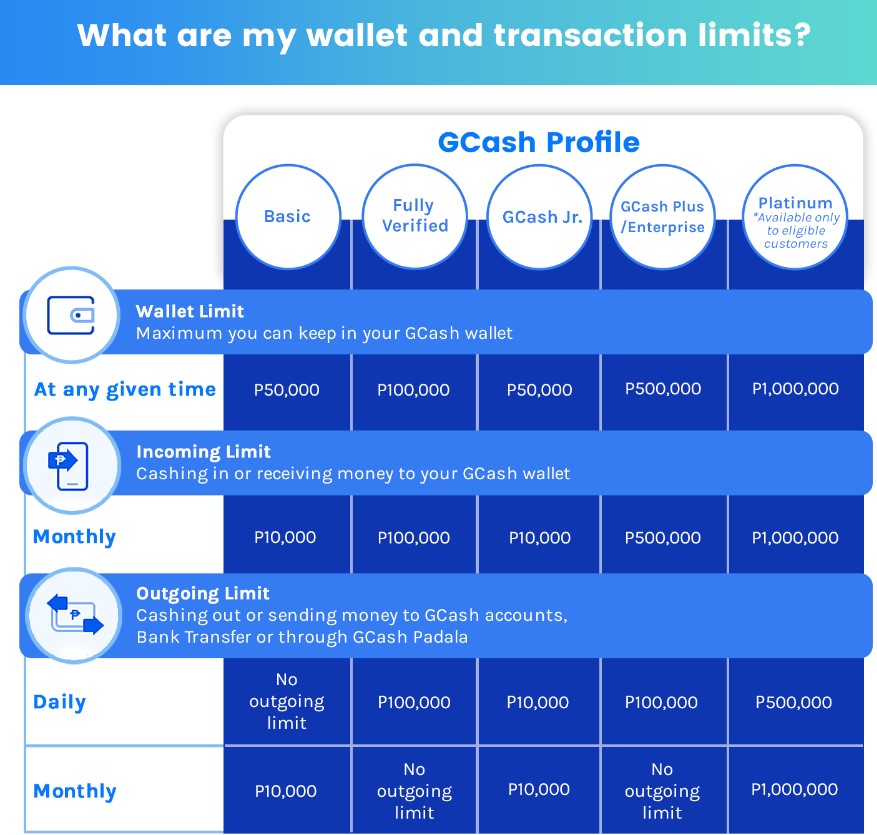

The GCash-to-GCash transfer limit is the maximum amount of money that can be transferred from one GCash account to another. As of January 2023, the maximum amount that may be transferred to another GCash wallet per transaction daily is PHP 500,000 for a Platinum account and PHP 1,000,000 monthly.

You can transfer up to 100,000 per day and a maximum of 100,000 per month if you have a fully verified Gcash account. Read also Gcash to Gcash Transfer Fee.

Checking the GCash-to-GCash Transfer Limit

Follow these methods to check your GCash to GCash transfer limit:

- Launch the GCash app on your smartphone.

- Sign in to the account.

- Tap the icon labeled “Cash-In” on the home screen.

- Select “GCash” as the funding source.

- Enter the amount you wish to transfer and the recipient’s GCash wallet number.

- If the amount you wish to transfer exceeds your transfer limit, the app will notify you.

- Before sending money to another GCash user, it is vital to check your GCash-to-GCash transfer limit to avoid any problems or delays.

Read: Gcash Cash in Fees

Increase Your GCash to GCash Transfer Limit

If you often move funds between GCash accounts, you may have reached GCash’s transfer limit. This is the maximum amount you can transfer each day and per transaction. There are, however, methods to enhance the GCash-to-GCash transfer limit.

1. Link your bank account

By linking your bank account to your GCash account, you can also boost the GCash-to-GCash transfer limit. By doing so, you can transfer dollars between your bank account and your GCash account. You can link your bank account to the GCash app by selecting “Bank Transfer” and following the on-screen steps. After integrating your bank account, you are able to transfer monies from your bank account to your GCash account, hence increasing your GCash-to-GCash transfer limit.

You can boost your transfer limit to PHP 100,000 per transaction and PHP 500,000 per day by confirming your account.

2. Request for a limit increase

You can request a limit increase if you have verified your GCash account, upgraded your GCash wallet, and linked your bank account but still require a greater transfer limit. To accomplish this, contact GCash customer service via the GCash app or website and submit the required details. GCash will analyze your request and, depending on your account’s activity and history, may provide a larger transfer limit.

By following these steps, you can boost your GCash-to-GCash transfer limit and take advantage of a more convenient and efficient method of sending payments. However, keep in mind that the transfer limit is imposed for security and anti-fraud purposes, so be cautious when transferring big sums of money and verify the recipient’s GCash account prior to sending the funds.

Conclusion

The GCash-to-GCash transfer limit is an essential consideration when utilizing the mobile wallet application. The daily and monthly limits exist to protect all GCash users. To surpass the transfer limit, you might send the funds in numerous transactions.

With the GCash app, it is simple and convenient to transfer funds to another GCash wallet. The app’s user-friendly interface expedites and simplifies the procedure. Always verify your GCash-to-GCash transfer limit prior to sending funds to another user to avoid difficulties.

Read:

Last modified: February 18, 2023