Why wait at the bank or for someone else to personally hand over the cash when there’s a better option? Gcash makes it easier for funds to be transferred from one person to another seamlessly and in a secure way through Gcash cash in.

Cash in Money from Gcash to a Bank

Everyone knows how going to the bank can take a lot of time and energy. But with Gcash, you can transfer funds within minutes without going outside.

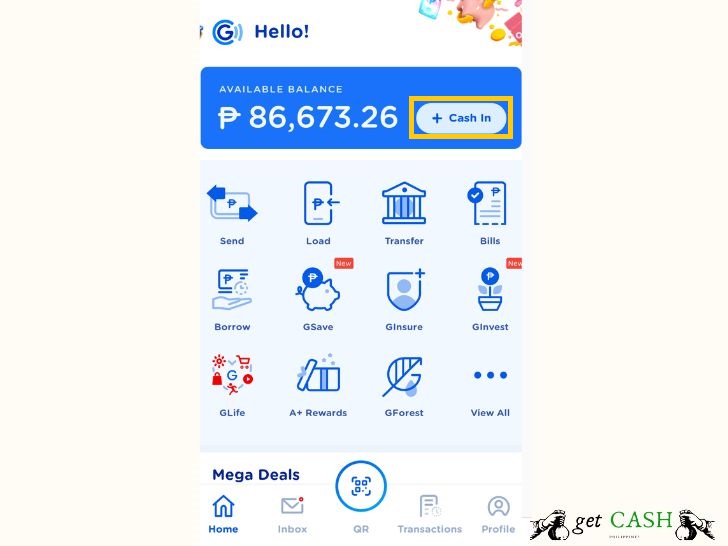

1. Open and log in to your Gcash account using your MPIN.

2. Tap Cash-in next to the balance.

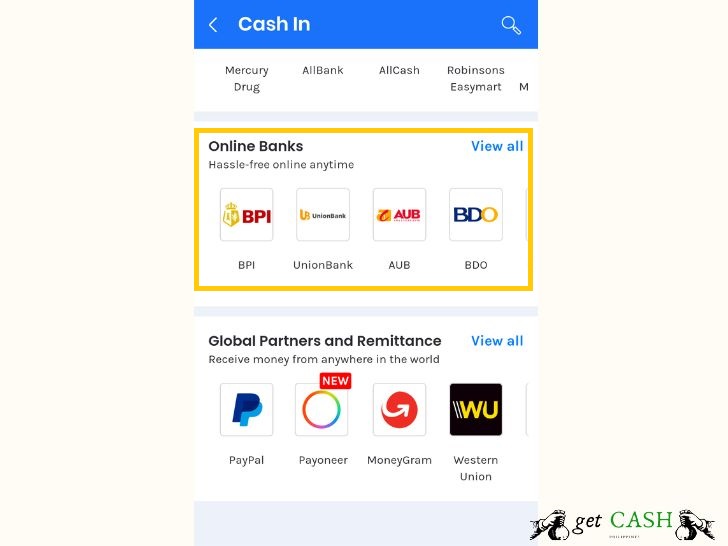

3. Scroll down under Online banks and choose your bank.

4. Enter all the information being asked such as name and amount.

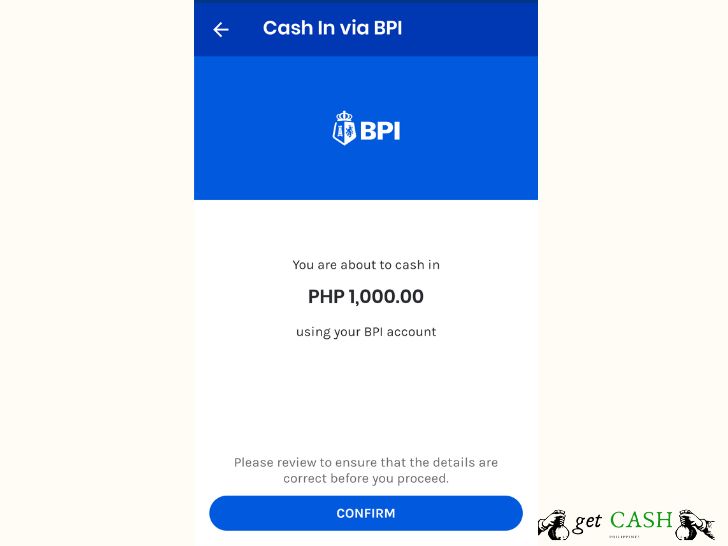

5. Verify the details and choose CONFIRM.

6. Wait for the authentication code from your manually to encode them and hit on submit.

7. Wait for the confirmation message via sms or email that the amount has been transferred.

A simple move and you are saving time, space, and even money moving from the bank to your place. Get this feature activation to fully benefit from the services Gcash has to offer.

Reload via Partner Banks

Cash in is a feature of Gcash that allows you to transfer funds or cash to your Gcash wallet.

TO withdraw funds over-the-counter, from the bank, or via remittance, you have to follow these steps first.

Step 1: Open your GCash app and click the Burger menu on the upper left of the page.

Step 2: Select My Linked Account.

Step 3: Select the name of the bank you wish to link.

Step 4: Input your credentials (username and password).

Additional steps for Unionbank users:

Step 5: Wait for the confirmation message with your OTP (one-time-password) on the mobile number registered to your UnionBank account.

Step 6. Select your preferred account (savings or current).

Step 7. The confirmation page shows all the details of the transaction. And you’ll receive a confirmation SMS on your UnionBank registered mobile bank that the transaction was successful.

Cash In using BPI

Step 1: On the dashboard, select Cash in.

Step 2: Under My Linked Accounts, select the BPI icon. The previously registered details of your BPI account will be automatically linked.

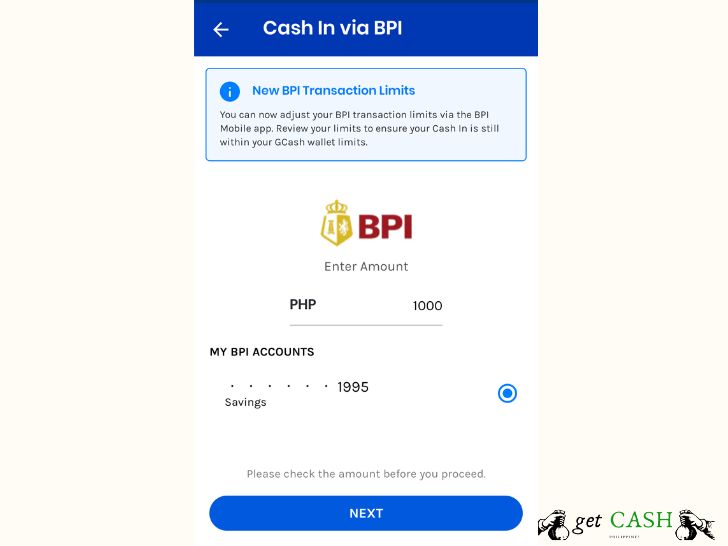

Step 3. Key in the amount you wish to cash in. Choose which BPI account you wish to cash in from. Then tap Next.

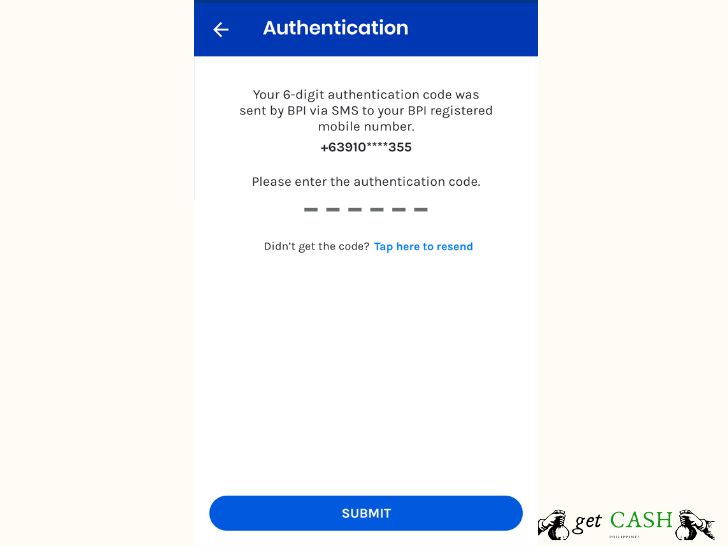

Step 4: Wait for the authentication code to the BPI-registered mobile number. Enter the code sent in the space provided.

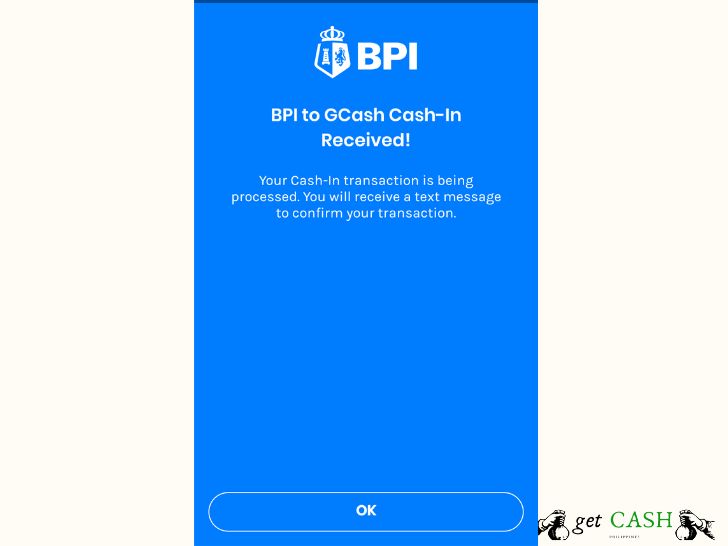

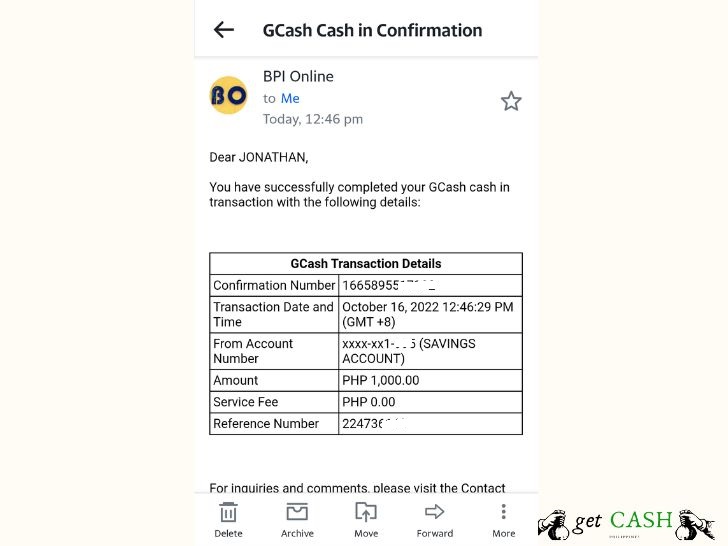

Step 5: Once successful, you will see the confirmation page. The amount should automatically reflect in your Gcash account. A confirmation SMS and email will be sent to you indicating the successful transaction.

Read: Transfer Money From BPI & BDO to Gcash.

Cash In using UnionBank

Step 1: On the dashboard, select Cash in.

Step 2: Under My Linked Accounts, select the UnionBank icon. The previously registered details of your UnionBank account will be automatically linked.

Step 3. Key in the amount you wish to cash in. Then tap Next.

Step 4: Next is the confirmation page. The amount should automatically reflect in your Gcash account. A confirmation SMS and email will be sent to you indicating the successful transaction.

Deposit using your Mastercard or Visa Card to GCash

Step 1: Tap on your Gcash app.

Step 2: Select Cash in.

Step 3: On the list, select Bank Cards or MasterCard/ Visa Bank.

Step 4: Key in the amount you wish to cash in. If you have registered multiple cards, select the appropriate card you wish to use. Then tap Submit.

Step 5: Review your entry, then tap on Confirm.

Step 6: A confirmation SMS will be sent to you. Check your balance in the dashboard to confirm if the correct amount is reflected.

Cash In through Remittance

Western Union and Moneygram

Step 1: On your Gcash app choose Cash In.

Step 2: Under Remittance, select Western Union or MoneyGram.

Enter the exact amount of remittance plus the Reference Number.

Key Reminders:

Western Union has a 10-digit MTCN while MoneyGram has eight (8). The remittance expires within 90 days. So, ensure that you withdraw immediately.

Step 3. Wait for the confirmation page to reflect the details of the transaction. Once on this page, confirm the information provided. The amount you entered will be automatically transferred. A confirmation text message will also be sent from 2882 as a receipt of the remittance.

How to load Gcash through PayPal

Before reloading your Gcash via Paypal, make sure that you have already linked there two accounts. Also, your PayPal account must be verified. Here are few more details that you have to take note of:

- The name on your PayPal account must match the name on Gcash.

- Paypal must have been created in the Philippines.

- It should be under a personal account, NOT a business.

To cash in, follow these steps:

Step 1: Open your Gcash app. Select Cash in on the Dashboard.

Step 2: Choose the Paypal icon under My Linked Accounts.

Step 3: You will see the funds available in your PayPal account. Enter the amount your wish to transfer. Then tap Next.

Step 4: A confirmation page will pop up stating that the process will take up to 24 hours to complete.

Step 5: Once funds have been transferred, a confirmation text message will be sent to your Gcash registered mobile number.

Take note that the minimum amount is Php 500. For a seamless transaction, convert your PayPal funds to Philippine peso in your PayPal account.

Payoneer has been recently added as a channel to cash in and out. Like Paypal, it requires the owner to link their Payoneer account with Gcash to continue with the process. Once done, you can add Payoneer to your Linked Accounts for all future cash in and withdrawal.

Reload through Seven-Eleven and other Partners

CliQQ Kiosk Via 7/11

Step 1: Go to the nearest 7-Eleven branch with a CliQQ kiosk

Step 2: At the kiosk, Under E-money, select GCash.

Step 3: Enter the Gcash registered mobile number and the account you wish to cash-in. Select Confirm.

Step 4: Wait for the printed barcode or you can take a screenshot of the barcode.

Step 5: Present it to the counter to pay the amount.

Step 6. You will receive a confirmation SMS of your transaction.

Filling up forms at the following Outlets:

- Robinsons

- Puregold

- Tambunting

- RD Pawnshop

- Palawan

- ECPay

- Posible

- ExpressPay

Step 1: Visit a Partner Outlet informing the authorized personnel that you wish to cash-in.

Step 2: Ask for a Gcash Service Form and fill up all the details. Include your Gcash registered mobile number and the actual amount you wish to reload in your Gcash.

Step 2: Present a valid ID with your payment at the counter.

Step 3: You will receive a text message confirming your request. Wait for the SMS before leaving to ensure the transaction went through.

Using Barcode in the following outlets:

- Puregold Supermarket

- SM Department Store and Supermarket

- Savemore

- TrueMoney

- Ministop

- Bayad Center

- LBC

- Villarica

Step 1: Inform the cashier or personnel that you wish to make reload your Gcash wallet or cash in.

Step 2: Open your Gcash app. Tap Cash in. Under Over-the-counter, click View All, to choose the desired partner outlet.

Step 3: Under Cash in, click on Generate Barcode button.

Step 4: Enter the amount then select Generate Barcode.

Step 3: Show the barcode to the cashier.

Step 4: The cashier will confirm the code, collect the payment, and print the recipe. A confirmation text message will be sent by 2882.

How to reload Gcash using Load?

You can no longer convert your prepaid load to Gcash as per the Gcash mandate.

Gcash Cash in fee

As of November 1, 2020, all bank transfers will be charged Php 0 to 50 depending on the bank per transaction.

- BPI

- PayPal

- Unionbank

- Asia United Bank (AUB)

- BDO Unibank

- LandBank

- Maybank

- Metrobank

- Philippine Bank of Communications (PBCOM)

- Philippine National Bank (PNB)

- Philippine Savings Bank (PSBank)

- RCBC

Over-the-Counter Cash-in

Cash in transactions is free until you hit the monthly threshold of Php 8,000. When your total transactions have exceeded Php 8000 for the month, you will be charged 2% of the amount. The fee is deducted from the amount you reloaded in your Gcash. Example: If you cashed in Php 1,000, you will only get Php 800 in your Gcash account because of the Php 200 fee (2% of Php 1000).

Cash-in via Remittance

The fee for remittances is the same as the over-the-counter transactions. Two percent (2%) of the amount cashed in is charged to your account.

Gcash Cash in Limit

You can add money in Gcash up to PHP 100,000 per month for Gcash with no linked bank account. And a monthly limit of Php 500,000 for accounts with linked bank or debit card.

You can put money in Gcash without the hassle. As listed above, you have several ways of how and where to cash in that will suit your need. Gcash provides a reliable and secure service to take care of menial tasks. That includes transferring funds so you can focus on what matters most. Explore all the potential Gcash has to offer and experience the power in your hands.

In any case you have any questions or problem about Gcash cash in follow our guide to reach Gcash customer service easily.

Read also: Steps to Withdraw Money from Gcash.

Last modified: October 17, 2022