Transferring money, nowadays, can be done in the comfort of your own home. No traveling or queuing is needed to finish one simple transaction. A quick and easy way to add funds to your Gcash account is through bank transfers.

With any transfers that include third-party entities, charges, and daily limits shall apply. The first limit is P30,000 per day but it increases to P50,000 the more you use the service. Transfers can cost up to P15 per transaction, depending on the bank you are wiring the money to.

Here are the step-by-step instructions on how to cash in via banks like BDO and BPI to Gcash and cash in from Gcash to a bank:

Cash in Money from Gcash to a Bank

Everyone knows how going to the bank can take a lot of time and energy. But with Gcash, you can transfer funds within minutes without going outside.

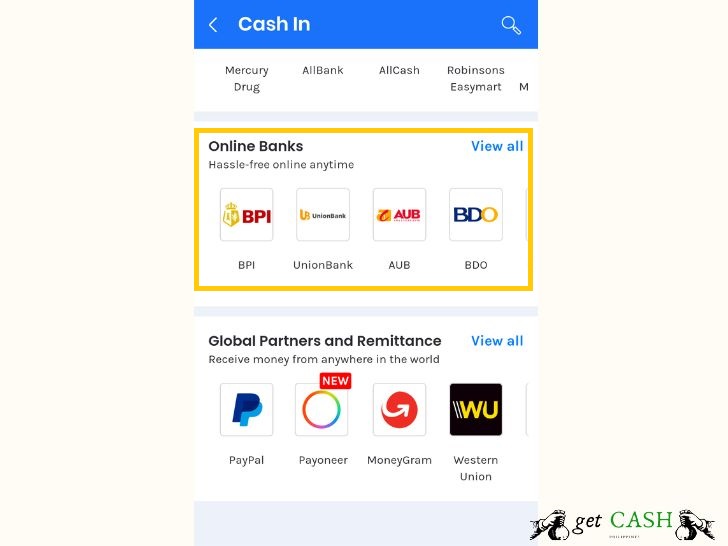

Gcash has partnered with 37 banks to ease the transfers from bank to Gcash and vice versa. Before proceeding you need to link your bank account first. Link your bank account to your Gcash by enrolling the feature with your respective banks. Once this is done, you can proceed to cash in through Gcash.

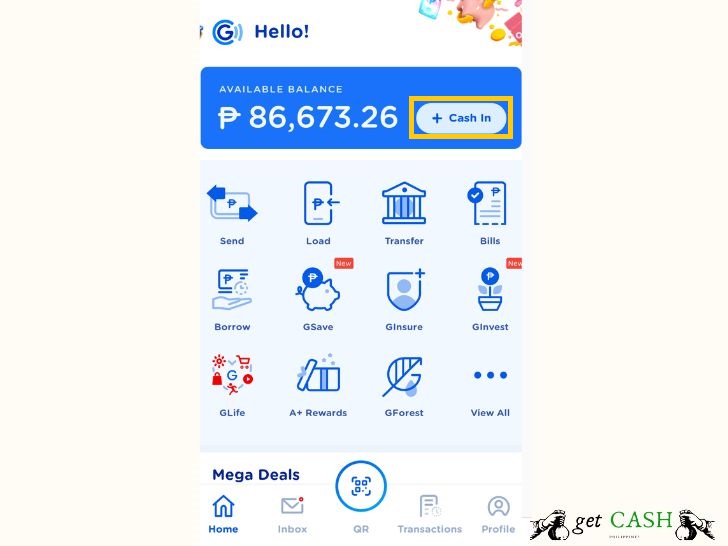

1. Open and log in to your Gcash account using your MPIN.

2. Tap Cash-in next to the balance.

3. Scroll down under Online banks and choose your bank.

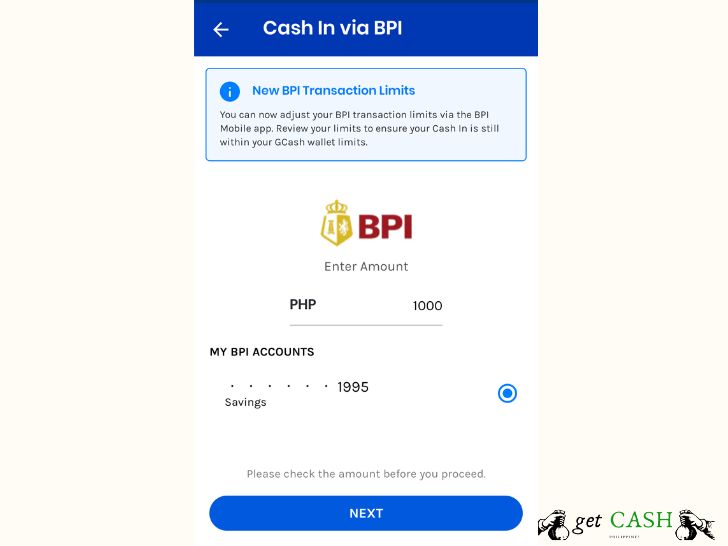

4. Enter all the information being asked such as name and amount.

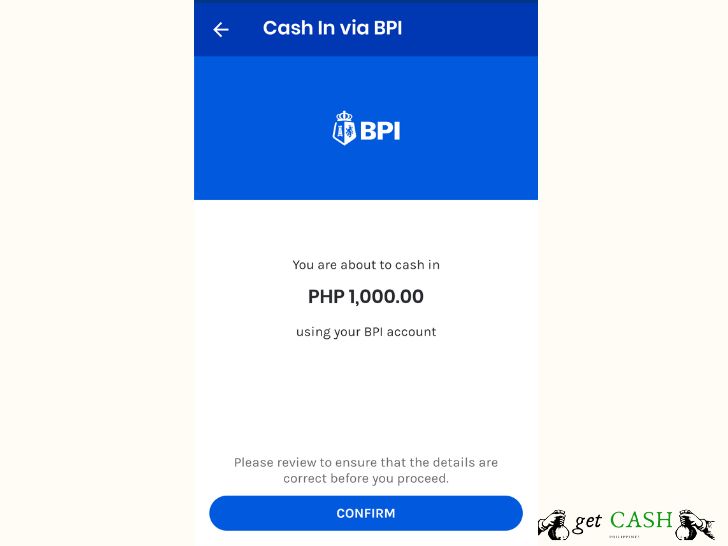

5. Verify the details and choose CONFIRM.

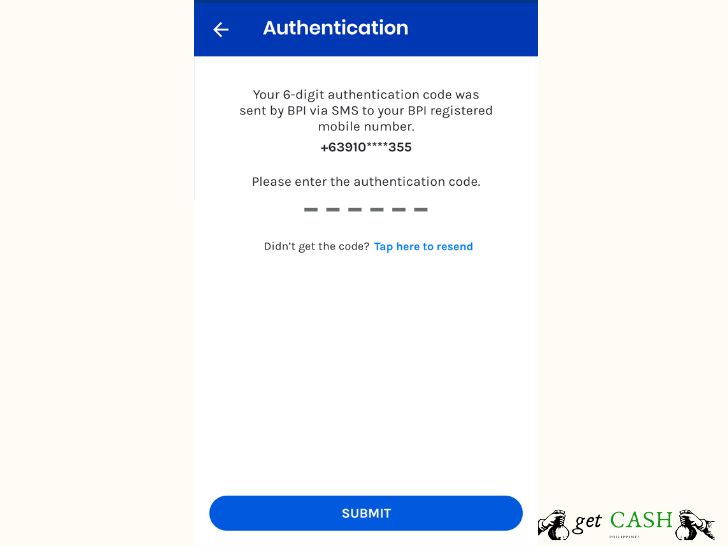

6. Wait for the authentication code from your manually to encode them and hit on submit.

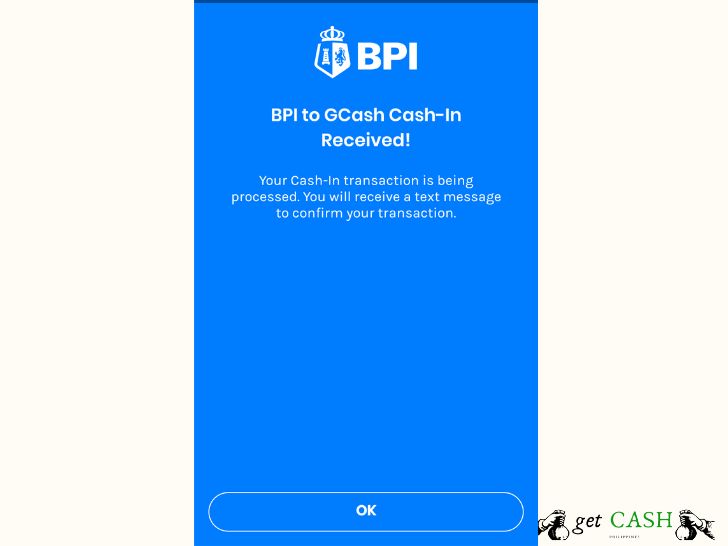

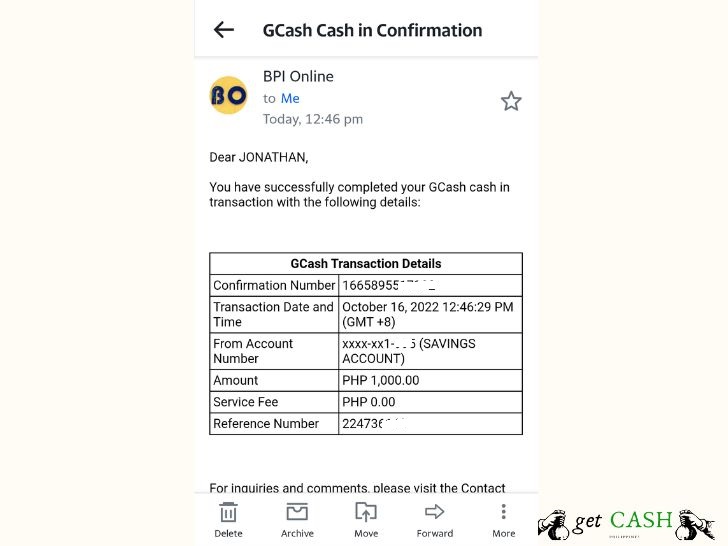

7. Wait for the confirmation message via sms or email that the amount has been transferred.

A simple move and you are saving time, space, and even money moving from the bank to your place. Get this feature activation to fully benefit from the services Gcash has to offer.

Cash in from BDO to Gcash

STEP 1: Access BDO Personal Banking or Mobile Banking.

STEP 2: Choose Send Money then To Another Local Bank then tap on GCash.

STEP 3: Enter all the details needed including the mobile number registered with Gcash using the format 09XXXXXXXXX.

STEP 4: Redeem the One Time PIN sent to your phone or generated by the BDO Mobile App.

STEP 5: Check your details and continue with the order.

You will incur P25 per successful transaction, deducted immediately from the available balance on your Gcash account.

Cash in from BPI to Gcash

First option – Transfer via Instapay

STEP 1: Download the BPI Mobile app and log in.

STEP 2: Tap on Transfers, then choose Transfer Money, lastly, tap on Transfer to another bank.

STEP 3: Choose GCash from the list of banks and fill out the form. The mobile number you registered on your account is your Gcash account number. Follow the format 09XXXXXXXXX.

STEP 4: Verify the details you entered. Key in the 4-digit One-time PIN or OTP sent to your mobile number registered with BPI.

When using BPI via Instapay, you will incur a transfer fee of P25.00.

The second option is – Transfer via Load E-Wallet

STEP 1: Open the BPI Mobile App.

STEP 2: Tap on Payments/Load then choose Load E-Wallet.

STEP 3: Enter your details in the “Load to” field including the mobile number registered via Gcash. This serves as your Reference Number and must follow the format 09XXXXXXXXX.

STEP 4: Verify and confirm the details you’re entered. Type your One-Time PIN (OTP) or Mobile Key that will be sent to your BPI-registered mobile number.

To link your BPI account, you must add your BPI details to your Gcash account. All you need is to tap Profile on the Dashboard the My Linked Accounts. Choose BPI from the list of banks and enter your BPI Username and Password. Once done, you can seamlessly transfer to your Gcash account anytime.

A list of available banks where you can cash in

- BPI

- UnionBank

- AUB

- BDO

- EastWest Bank

- LandBank

- Maybank

- Metrobank

- PBCOM

- PNB

- PSBank

- RCBC

- Security Bank

- UCPB

Most, if not all, of the banks listed above, have their own mobile banking app. Thus, it is recommended that you download the application of your bank to ensure smooth transactions. Before any cash-in request, ensure that you have enough funds to cover the fees. Bank transfers remain to be an effective and efficient way to cash in.

Read:

Last modified: October 16, 2022