Is a credit card available in Gcash? The answer is YES and NO. For Gcash, they have Mastercard and Gcredit. Mastercard is the physical card that gives the subscriber access to the amount available in their Gcash account. Whereas, Gcredit allows subscribers to get a loan to pay for bills and purchases.

What is Gcash Mastercard and how does it differ from Credit card?

The Gcash Mastercard is a reloadable physical card that you can use to pay to purchase online and offline, and also to withdraw cash. Thus, it combines the good points of a debit and credit card.

The huge difference between the Gcash Mastercard and credit card is the usage of funds and application.

For credit cards, one has to submit documents to the bank. Applicants would need to wait if their application is approved or not. Once approved, the subscriber can use their credit card to purchase and pay bills online or offline. And, pay for the amount after a month or in installment.

When applying for Gcash Mastercard, applicants don’t need any documents as long as they have a FULLY VERIFIED Gcash account. All they need to do is to pay for the Mastercard which is Php 150 for the card and Php 65 for the delivery fee. What is left is waiting for the card to be delivered via mail. Subscribers can only withdraw or use the money available in their Gcash account. They cannot exceed the amount available as payment will be denied.

As such, Gcash Mastercard is for the mass public who don’t have an existing bank account or don’t have the means to open one. An ideal set-up for freelancers, housewives, students, and other subscribers who need a better way to handle their finances. It also ensures people that they spend only the cash available, not overspend.

What is Gcredit?

Gcredit is a Gcash feature powered by CIMB Bank that allows subscribers to have a revolving credit they can use for online/offline purchases, as well as pay bills. Gcash subscribers can apply for Gcredit as long as they are qualified and met the following requirements:

- Gcash account is fully verified.

- At least 18 years old and above.

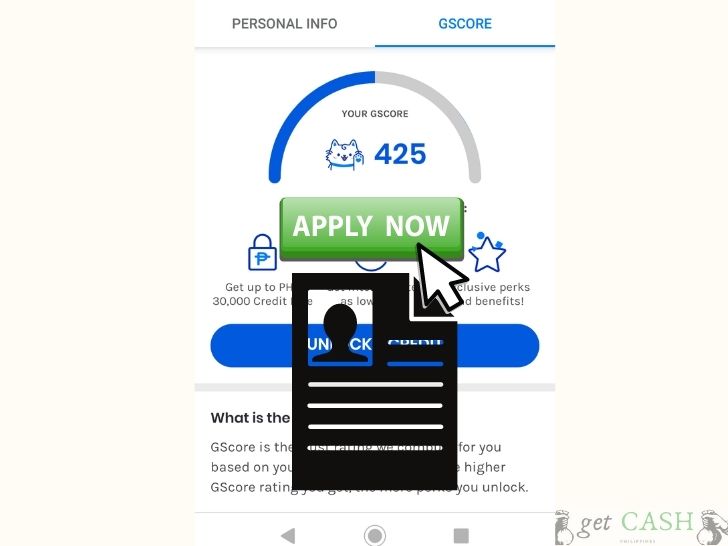

- Have high GScores.

The Gscore is the main criteria that dictates how much a subscriber can loan from Gcredit. Subscribers with high GScores can loan up to a maximum amount of Php 10,000 with an interest rate of 1%.

To increase Gscore and have a higher chance of getting higher credit limit, subscribers need to the following:

- Start to use a GSave account.

- Start to use Invest money.

- If you already have a GSave and/or Invest money one, use it regularly.

- Do weekly transactions in Gcash.

- Use Gcredit to pay for bills and pay using the QR code.

Like regular credit or loan applications, applicants have to wait for their application to be approved or disapproved. But unlike the former, you don’t need to submit bank documents to get your application approved. Everything will be based on your GScores.

Gcash is superior in many ways. They have made these features, Mastercard and Gcredit, available for even ordinary folks who might not have all the means to get one from a regular bank. With these features, when used wisely, they can get ahead of their game and manage their funds efficiently.

Read:

Last modified: September 6, 2021